What’s Behind China’s Fintech Growth?

By Oliver Rui

In 2001, among the world's five largest companies by market capitalization there was only one technology company: Microsoft. In 2016, the five largest companies in the world, by market cap, were all technology companies. And just as it has transformed the rest of the world, tech is also changing the old and very traditional industry of finance. Read on for an analysis by CEIBS Professor of Finance & Accounting Oliver Rui.

Some people say the development of financial technology in Silicon Valley is ‘from 0 to 1’, while its development in China is ‘from 1 to 100’. Last year, Goldman Sachs released a report on financial technology, which mentioned the following data:

- Third-party payment: from 1.1 trillion to 107.3 trillion

From 2010 to the end of 2017, the scale of third-party payment transactions has increased by more than 97 times. About 16% of transactions are related to consumption, and 56% are from individuals. - Online lending: from 28 billion to 2.8 trillion

From 2012 to the end of 2017, the total assets of online lending increased 100 times.

Financial technology overview

Last year, the amount of financing pumped into China's financial technology reached US$7.7 billion, while in the United States it was US$6.2 billion. China's investment in financial technology far exceeds that of the United States; in fact it leads the world.

The 2017 Financial Technology Adoption Index released by Ernst & Young shows that China's financial technology adoption rate index is the highest, reaching 69%, while the United States is at 33%, and the global average is 33%. In other words, China's fintech adoption rate is already double that of the United States and also twice as much as the rest of the world.

In 2017, five of the top 10 global fintech companies were from China, including renowned brands such as Ant Financial, Lufax (Shanghai Lujiazui International Financial Asset Exchange Co.), Zhong’an Online P&C Insurance, JD.com, etc. In the past few years, China's financial technology sector had a growth spurt. These are the main reasons:

1. The huge amount of Chinese netizens

Smartphones and PCs are being used by more than 700 million people, providing a foundation for the rapid development of financial technology in China.

2. Small and micro enterprises hungry for financing

Small and micro enterprises receive less than 20% of loans from financial institutions, which provides a huge demand for the development of financial technology.

3. Unmet financial needs of ordinary people

Most people are not being served by traditional financial institutions due to a lack of relevant credit records.

4. Financial management threshold

Before the new financial regulations were rolled out on April 4, 2018, the minimum wealth management threshold was RMB 50,000, but many ordinary families do not have RMB 50,000 to invest.

5. Regulatory arbitrage

Traditional financial institutions and regulatory agencies have a dual-track regulatory mechanism which creates conditions for regulatory arbitrage, where companies take advantage of loopholes in order to avoid unprofitable regulations.

6. Rigid payment habits

In the past 10 years, the Chinese people have developed rigid payment habits, which provides the basis for the development of financial technology in China.

7. Limited awareness of need to protect personal privacy

Financial technology is inseparable from data, and Chinese people's awareness of privacy protection is relatively weak, enabling financial technology companies to obtain large amounts of data at low cost.

Impact of financial technology

What changes will be brought about by financial technology, and what impact will it have on traditional financial institutions? These are the main areas to keep an eye on:

1. Innovation in financial services

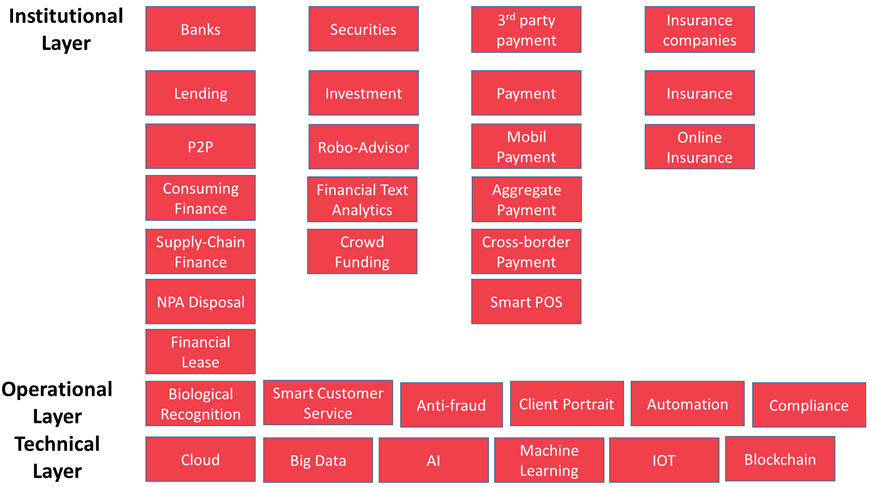

‘Finance + Technology’ or ‘Technology + Finance’ will generate many new formats, such as insurance technology, regulatory technology, smart investment, and third-party payment.

2. Efficient and low-cost services

If we go to a bank’s physical outlet to do a routine transaction, the cost is about $3; but if we switch to mobile banking, the cost can be reduced to 8 cents.

3. Inclusive finance

In China, no matter whether it is a small or micro enterprise or members of an ordinary family, many financial service needs have not been met. In the internet era, the marginal cost is zero, and financial technology will change the original supply curve. Customers who have not been served before can be served now.

4. Risk management data

Standard data, general consumption data, and behavioural data from the central bank's credit reporting system can help provide effective risk control.

5. Goods or services from the needs of users

The internet age is a buyer's market. Individual consumers need personalized services, but in the long process of information transmission, a lot of information is filtered out and only standardized services can be provided. In the financial technology era, demand for these services or goods is initiated by users, changing the previous logic behind services and products.

6. Financial service scenario

From the original long chain to the network matrix, you can provide users with personalized solutions in a timely manner.

7. Financial democratization

The traditional financial era is vertical, and financial markets are monopolized by a few elites. However, with the internet era, financial services are flatter, many products are more affordable or accessible to more investors, and there is more equality in the status of financiers and investors.

New wine or simply old wine in new bottle?

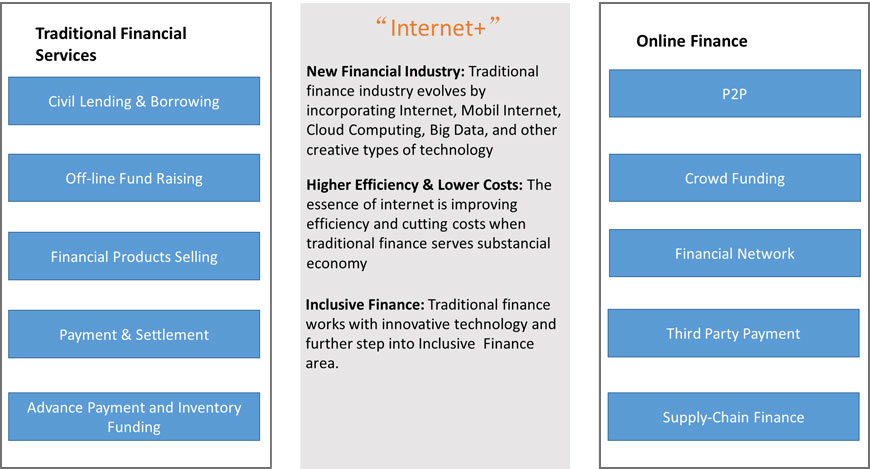

At present, the common formats we have observed in the 1.0 version of financial technology are: P2P, crowdfunding, financial online sales, third-party payment, supply chain finance... These are very similar to what we see in traditional financial services. So is financial technology 1.0 new wine or merely old wine in a new bottle?

Traditional financial business vs internet finance

To answer this question, we must first understand what finance is all about. Whether it is called technological finance or financial technology, it is inseparable from the core of finance. Finance is aimed at realizing the rational distribution of capital across space and time under uncertain conditions, and to serve the real economy in its efforts to maximize social utility.

In this process, the biggest obstacle is the adverse selection caused by information asymmetry and moral hazard; that is, bad money drives out good. In finance, what we have to solve is the adverse choice brought about by information asymmetry. Whether it is financial technology or technological finance, ‘information’ and ‘credit’ are inseparable. The core ability of finance is to identify risks and price them. All technology is designed to help us better understand the customer's willingness and ability to repay, to accurately put a price on those factors, and allocate limited resources to those entrepreneurs who can create value for society.

Therefore, according to the above theoretical framework, I believe that today's 1.0 version of financial technology is still "old wine in a new bottle, and has not changed the underlying nature of finance."

The emergence of technologies such as the internet has changed the scope, number, amount and environment of financial transactions but has not changed the nature of financial transactions. Financial technology is not new finance, but an innovation in the sense of financial sales and access channels. Financial technology challenges traditional banks and capital markets at the channel level, but there is no difference in structure and design from products operated by banks, insurance, capital markets, etc. The nature of finance has not changed; that it to say the intertemporal value exchanged by all parties to the transaction is the exchange of information and the identification and pricing of risks.

Today we are in the ‘warring states era’ of financial technology. In all relevant fields, there are both traditional financial institutions and high-tech companies, but they all have boundaries. These boundaries are determined by cost, because there is no company willing to run a loss-making business; maybe it can bear short-term losses, but it is impossible to have a long-term loss-making business.

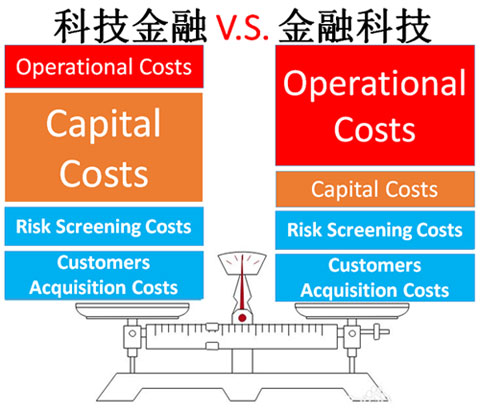

In other words, financial technology is determined by cost. In the process of providing financial services, there will be four costs: ‘operating, capital, risk screening, and customer cost’, but whether it is financial technology (finance + technology) or technological finance (tech + finance), the way the two are combined depends on their relative costs.

In terms of capital cost, banks or traditional financial institutions have natural advantages. In terms of operating cost, internet companies or high-tech companies have natural advantages. We originally thought that the cost of online customer acquisition was very low, but in fact today's online customer acquisition cost has exceeded offline customer acquisition cost.

Cost of financial technology (left) vs technological finance

Financial technology has innovative genes, a corporate culture that is more in line with the spirit of the internet, a regulatory arbitrage space, and a first-mover advantage in platform competition. Therefore, the advantages of high-tech internet companies include being able to sell standardized financial products and the ability to serve the long tail market at lower cost, especially within their core capabilities. Of course, high-tech internet companies cannot outperform and prevail in every field, but in terms of core capabilities they can accurately grasp specific information about all their customers.

|

Comparative advantage of traditional financial institutions |

Comparative advantage of internet companies |

|

|

Currently, the services of all traditional financial institutions have been eroded by financial technology companies. In the future, financial technology and technological finance must be interdependent and complementary, it will be difficult to distinguish between the two.

Spring is approaching

In 2018, China's internet finance is experiencing a cold winter, as seen from the stock price of listed companies in the field. Many are busy changing their names. For example, JD Finance changed to JD Digital Science, Baidu Finance changed to Du Xiaoman Financial, and Ant Financial Cloud changed to Ant Financial Technology. The biggest risk for fintech companies is regulatory risk, and recent government regulations have had a negative impact on these companies.

Take the internet finance industry as an example. Let's look at the data as of the end of 2017. The total assets of the six major state-owned banks was RMB 107 trillion, total assets of internet banks was RMB 200 billion; the size of state-owned banks was RMB 55 trillion, the scale of P2P online loans was RMB 2.8 trillion; and the size of the six major state-owned banks was RMB 78 trillion. Meanwhile the size of internet bank deposits was RMB 51.9 billion; bank trust funds were RMB 8 trillion, and internet money funds were RMB 5 trillion.

In terms of volume, one is an elephant and the other is an ant, but I think that the ant may one day drill into the elephant's nose, making the elephant very uncomfortable.

Bill Gates once said: ‘We usually overestimate the changes that will occur in the next two years, but underestimate the changes that will occur in the next 10 years.’

What will financial technology be like after 10 years? I think spring is approaching. If you look closely, it is not difficult to see that the market value of ants is very close to the market value of elephants.

History tells us that for every revolution there is a bubble. Every revolution will bring a short-term retreat, but it will also bring prosperity to society. What is waiting for us now is the spring of financial technology, which is the prosperity brought by scientific and technological progress.

This is an edited translation of a speech given on November 2, 2018. Oliver Rui is Professor of Finance & Accounting at CEIBS.